ETH Price Prediction: Path to $5,000 Amid Technical Strength and Institutional Demand

#ETH

- ETH trading above 20-day MA indicates underlying bullish momentum

- Institutional accumulation and $3.2B liquid staking inflows provide strong fundamental support

- Technical resistance at $4,913 represents key level before $5,000 target

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

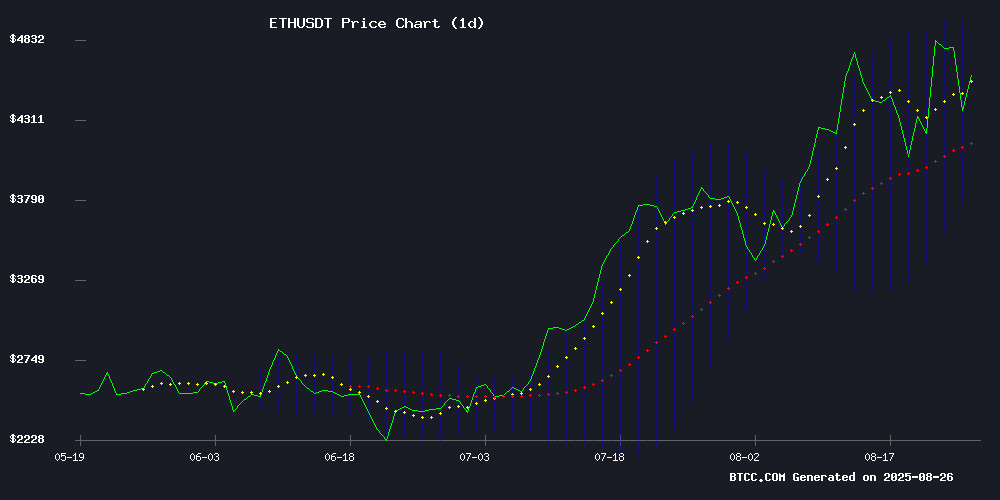

ETH is currently trading at $4,517.95, positioned above its 20-day moving average of $4,405.47, indicating underlying strength. The MACD reading of -219.13, though negative, shows improving momentum with a positive histogram of 97.91. Price action remains within the Bollinger Band range ($3,897.91 - $4,913.04), with current levels suggesting room toward the upper band. According to BTCC financial analyst Ava, 'The technical setup supports continued upward movement, with the $4,900 level acting as immediate resistance.'

Market Sentiment: Institutional Accumulation and Bullish Projections Drive Optimism

Recent headlines highlight significant institutional activity, including SharpLink Gaming's $3.6B ETH holdings expansion and ETHZilla's $489M ethereum treasury. Multiple analysts maintain bullish outlooks, with predictions reaching $15,650 long-term and $5,200 by September. Standard Chartered's undervaluation call and massive $3.2B inflows into liquid staking within 14 weeks further reinforce positive sentiment. BTCC financial analyst Ava notes, 'The combination of institutional accumulation and strong fundamental projections creates a favorable backdrop for ETH's price appreciation.'

Factors Influencing ETH's Price

SharpLink Gaming Expands ETH Holdings to $3.6B Amid Institutional Buying Spree

SharpLink Gaming, the Nasdaq-listed digital asset treasury firm led by Ethereum co-founder Joe Lubin, has significantly bolstered its ETH reserves. The company acquired 56,533 ETH last week, bringing its total holdings to nearly 800,000 tokens worth approximately $3.6 billion. Purchases were executed at an average price of $4,462 per ETH between August 18 and August 24.

The Minneapolis-based firm also reported $360.9 million in net proceeds from its at-the-market share issuance program, with $200 million remaining for additional acquisitions. Staking rewards have grown to 1,799 ETH since the treasury strategy launched in June.

Institutional demand for ETH continues to surge, with treasury firms accumulating 2.6% of the asset's circulating supply in recent months, according to Standard Chartered. BitMine Immersion Technologies leads with 1.7 million ETH, followed by SharpLink's 800,000 tokens.

SharpLink's stock rose 1.1% following the announcement. The company has approved a $1.5 billion stock buyback program as a safeguard against potential declines below net asset value.

Ethereum Price Rattles After $4.8K High – What’s Next?

Ethereum's price action has taken center stage once again, surging to a multi-month high near $4,884 before retreating to $4,517—a 3% drop within 24 hours. Analysts attribute the pullback to excessive derivatives leverage, whale sell-offs, and bearish RSI divergence across timeframes.

While ETH cools off, speculative capital appears to be rotating toward high-beta altcoins. Meme coins like Maxi Doge ($MAXI) are gaining traction, leveraging presale urgency and community hype to attract over $1.55 million in early funding. The shift underscores retail's appetite for asymmetric bets amid uncertain macro conditions for majors.

The failed breakout above $4,884 triggered cascading liquidations, wiping out overleveraged longs. Despite stabilization around $4,517, technical indicators suggest caution—RSI divergence on daily and 4-hour charts signals weakening momentum as the $5,000 psychological barrier looms.

Ethereum (ETH) Price Prediction: Analysts Maintain Bullish $15,650 Outlook Despite Short-Term Pullback

Ethereum faces short-term volatility after failing to sustain momentum above $4,775, triggering a 3.95% drop to $4,422. Daily trading volume surged 121% to $62 billion as profit-taking intensified near all-time highs.

Technical indicators suggest consolidation, with RSI at 59.8 and MACD showing fading bullish momentum. Key support now rests at $4,400, while resistance looms at $4,900.

Long-term fundamentals remain robust. Staking demand, Layer 2 adoption, and institutional interest continue to fuel projections of a $15,650 price target. Market structure favors accumulation during pullbacks.

Standard Chartered Sees Ether and ETH Treasury Companies as Undervalued Post-Plunge

Ether (ETH) and companies holding ETH treasuries appear undervalued following recent price declines, according to Geoff Kendrick, Standard Chartered's global head of digital assets research. Institutional demand has surged, with ETH treasury companies acquiring 2.6% of circulating supply since June—jumping to 4.9% when combined with ETF inflows.

The cryptocurrency briefly touched a record $4,955 on March 24 before retreating below $4,500. Kendrick maintains his $7,500 year-end price target, framing the dip as a buying opportunity. "These inflows are just beginning," he noted, reiterating his projection that treasury firms could eventually hold 10% of ETH's circulating supply.

Valuations for ETH-focused firms like Sharplink Gaming and Bitmine Immersion have normalized, with their mNAV multiples now below that of MicroStrategy's Bitcoin-heavy strategy. The trend highlights growing institutional differentiation between crypto asset classes.

Best Crypto to Buy Now: Ethereum, Hyperliquid, Or Token6900

As the cryptocurrency market correction continues, investors are actively seeking opportunities for explosive growth. Ethereum, the leading altcoin, has surged 245% since April, currently trading at $4,480 despite a recent 3.43% dip. Hyperliquid has outperformed with nearly 400% gains during the same period.

While these established players show promise, attention is shifting to Token6900, a low-cap ICO drawing inspiration from SPX6900's remarkable 11,275% annual return. The project has already raised $2.6 million in its presale phase, attracting meme traders anticipating similar volatility.

Token6900's strategy mirrors SPX6900's successful formula of satirizing traditional markets while offering outsized return potential. With its presale nearing conclusion, the token is gaining traction among risk-tolerant investors looking for the next viral meme coin.

ETHZilla Announces $250M Stock Buyback and Discloses $489M Ethereum Holdings

ETHZilla, a newly rebranded firm, has approved a $250 million stock buyback program aimed at bolstering its share price. The company holds 102,237 ETH, valued at approximately $489 million, as part of its crypto treasury strategy. With $215 million in cash equivalents, ETHZilla plans to execute the buyback through open market purchases or institutional deals by June 30, 2026.

The move is designed to exert upward pressure on the stock price while increasing the ETH-per-share metric. "We are deploying capital with discipline to accelerate our Ethereum treasury strategy," said McAndrew Rudisill, Executive Chairman. The decision reflects a growing trend among firms embracing digital assets as part of corporate finance strategies.

ETH Price Prediction: Ethereum Targets $5,200 by September Despite Current Weakness

Ethereum's price trajectory presents a bifurcated outlook as technical indicators signal both opportunity and risk. After retreating 7.3% from its 52-week high of $4,832, ETH now trades at $4,479—a level market participants are scrutinizing for either strategic accumulation or further downside.

Analyst consensus remains divided. Bearish voices highlight failed support at $4,519 and bearish divergence in daily Stochastic indicators, projecting a near-term test of $4,400. Conversely, bullish forecasts employing Elliott Wave theory suggest the correction has completed, paving the way for a potential 17% surge toward $5,242.

The $4,400-$4,800 range now serves as critical battleground, with decisive breakout either confirming LiteFinance's optimistic $5,200 target or validating bearish warnings of extended declines toward $3,647.

Ethereum DeFi Activity Lags Despite ETH Price Surge to Record Highs

Ether's price ascent to a historic $4,946 this week contrasts sharply with tepid growth in its decentralized finance ecosystem. Total value locked across Ethereum DeFi platforms stagnates at $91 billion—17% below its November 2021 peak. The divergence grows starker when measured in ETH terms: just 21 million tokens currently locked versus 29.2 million during the 2021 bull market.

Layer 2 solutions are cannibalizing liquidity as Base, Arbitrum and Optimism collectively command billions in TVL. Modern protocols like Lido demonstrate how capital efficiency has reduced the need for massive token deposits that previously inflated metrics. "Infrastructure improvements and cross-chain competition have rewritten the playbook," observed analyst Nick Ruck, noting retail investors' absence from this cycle's rally.

While decentralized exchange volumes and perpetual contracts show activity, neither approaches previous highs. This disconnect suggests institutional players may be driving ETH's price action through spot markets rather than DeFi participation—a structural shift with implications for the network's fee economy.

$3.2B Floods Into Ethereum Liquid Staking Within 14 Weeks

Ethereum's liquid staking ecosystem has absorbed $3.2 billion worth of ETH over the past 14 weeks, signaling robust demand for yield-bearing crypto strategies. Nearly 690,000 ETH flowed into these protocols since mid-May, pushing total staked ETH to 14.31 million—representing 11.9% of the cryptocurrency's circulating supply.

Lido maintains its stranglehold with 61% market share, commanding $41.6 billion in staked ETH despite a marginal weekly decline. Binance Staked ETH emerges as the fastest-growing competitor, posting 11% monthly growth to secure its $15.7 billion position.

The sector's $68 billion valuation underscores liquid staking's transformation from niche experiment to cornerstone of Ethereum's DeFi infrastructure. This capital migration coincides with Ethereum's transition to proof-of-stake consensus, where staking yields now compete with traditional fixed-income products.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, ETH has a strong probability of reaching $5,000. The price is already above the 20-day moving average, showing bullish momentum, while institutional accumulation and positive analyst projections provide fundamental support. Key resistance lies near $4,913 (upper Bollinger Band), but breaking this level could open the path to $5,000.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,517.95 | Bullish |

| 20-day MA | $4,405.47 | Support |

| Upper Bollinger | $4,913.04 | Resistance |

| MACD Histogram | 97.91 | Positive Momentum |